Mapping stakeholders and their interests is a helpful but not a straightforward exercise for those dealing with the governance of mobility data platforms. Hidden agendas, shifts in stakeholder salience, and complexities varying per situation, limit the value of mapping stakeholders and have to be acknowledged to avoid attaching too much or the wrong value to the mapping.

Key words: mapping stakeholders, stakeholders’ interests, wicked issue

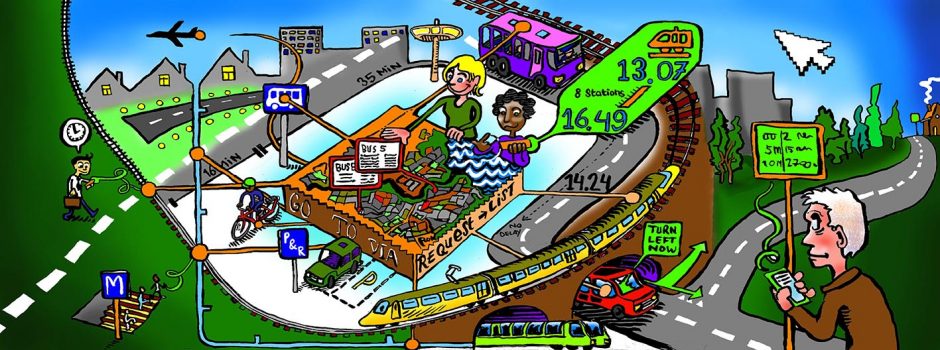

Top-down approaches to innovations have been replaced by more inclusive approaches that respect that stakeholders matter, as Bryson (2004) puts it. And if stakeholders matter, mapping them, their positions and interdependencies seems to be a sensible thing to do for developers of smart mobility platforms. This can provide insight in potential conflicts of interests, ways to mitigate them, and ensure that a platform is aligned with key stakeholders, facilitating its adoption. Mapping stakeholders, however, is less straightforward than it may seem. For example, stakeholder mapping may not reveal some major sources of conflicts of interests. Understanding why this is the case is important when mapping stakeholders. Before we go into this, we first describe a basic mapping of stakeholders of smart mobility platforms.

‘Stakeholder analysis has its roots in (corporate) management literature, but it is nowadays also applied in the field of public policy making’ (Hermans 2005). A stakeholder analysis can be used in many different ways, for either analytical or strategic purposes. It can be used before, during or after a project. In this column we discuss the mapping of stakeholders with an analytical purpose during the development of a smart mobility platform.

Generally speaking, there are a number of stakeholder categories that are relevant for smart mobility platforms, such as local authorities or end users for instance. These platform related actors may, in some cases, develop more than one role (initiator, funder, owner, designer/developer, implementer, manager). A generic illustrative list could include:

- End users (i.e., city residents and tourists);

- Transportation providers and managers (i.e. transport/infrastructure provider, manager, authority, operator and user, car sharing, etc.)

- Service and/or data providers (i.e. mobile communication providers, ITS providers, tourist organizations, etc.)

- Authorities (i.e. mobility agency, local government, etc.)

- R&D actors (i.e. universities, research centres, etc.)

Our analysis of the specific stakeholder categories in our cases (those studied for this handbook), leads us to clarify the generic list proposed above. Looking at these stakeholders with a specific focus on their role, position, incentives and relative power, is useful to capture in a more comprehensive way a system’s complexity examining it through its actors. This process enables the identification of challenges inherent to the wicked issue of smart urban mobility in growing urban areas in general and in particular the ones associated to governance of journey planning platforms. It thus seems to make sense to map stakeholders this way.

First, public authorities participate in digital mobility platforms in different roles (performing different tasks). They can be the owner, the (main) sponsor, a facilitator, supporter, regular participant or regulator. Impartiality and completeness of the information provided, as well as territorial coverage, are usually basic values sought by public authorities with a multimodal orientation, if their journey planning services are paid with public money. Melbourne’s platform, managed by Public Transport Victoria exemplifies this perspective. The management of crisis and traffic disruptions is also an important concern for public authorities. For all these reasons, access to and accuracy of data disclosed become critical. Public Transport Victoria, for instance, is concerned with reputational issues related to providing information that is incorrect and therefore they prefer not to provide real-time data.

Second, transport service providers have a commercial interest: while the information provided must be clear and objective, it may be selected and presented with a certain bias in order to attract customers to the operator’s network. The Dutch platform, 9292OV, was commissioned and is managed by private and public operators of public transport. A further role that transport operators may have in journey planning platforms is to be the data provider. Information that is transferred to the platform’s manager or developer is collected/produced by operators (either public or private). This is the case in London’s Plan a Journey or Lyon’s Optimod, for instance. The management of crisis situations is of great concern to operators as well and they are also cautious about publishing real-time information: aside from fearing reputational problems connected to information inaccuracy, as exemplified above, they prefer to avoid disclosing information that could highlight performance problems (delays, mechanical failures, etc.). VSS in Stuttgart, for example, jointly managed by transport authorities and private operators, makes all the data used in their platform available as open source but on certain conditions. One of these conditions is that no statistical use can be made with the data.

Third, users can be seen as customers of government services – authorities are expected to provide them with information on traffic conditions and public transport options as part of the public services a citizen receives. End users can also be seen in the role of consumers of services from profit-oriented platforms. In either case, it is important to acknowledge they also have multiple and varied interests and concerns. These range from the need to know how to travel from point ‘a’ to point ’b’, how to save travel time, avoid changing modes during a journey, choose a less polluting trip etc. Having a one-stop shop to provide solutions to their interests covering all stages of the journey is ultimately the task of a journey planning platform.

Fourth, data providers are a very diverse group both in terms of their nature as in terms of their values and interests. Private companies may have straight commercial interests in selling their data, while public organizations may be strongly motivated to prevent misuse of the data in terms of privacy violation and the reputational damage accordingly. Furthermore, there are also third party providers of functionality, depending on the degree of openness of the platform. For example, in the NLIP case the basic model was that the platform would allow for third party apps, which would provide both value added functionality and business cases (and hence incentives) for parties to connect and contribute to the platform. However, given that the platform is partly public and partly private, some actors perceived a risk that data shared on the platform for public or community purposes might be misused commercial apps, as it is exactly the combination of data that makes platforms so valuable.

Even though a sensible task to undertake, there are two major drawbacks to mapping stakeholders. First, any general mapping or typology sounds tempting but is in fact a simplification of the stakeholder landscape. Much of the value comes from understanding the actor landscape in a specific case, situation and context. Sometimes, a single stakeholder dominates many roles at the same time, which may absorb conflicts of interests but also instill them in the same actor. Other stakeholders may also turn out to have significant influence in some of these relevant roles but outside the core group of four in our typology, for example technology companies developing software and smartphone applications or firms providing back-office support (as described elsewhere in this Handbook for the case of Plan a Journey).

Second and perhaps most important, stakeholders are not a natural object that can be objectively observed. Stakeholders are not static and their positions and salience changes over time, which is visible in the NLIP case, where some inactivity at the side of government led to a change in the role of some of the businesses involved, shifting the salience of stakeholders from one business community (the platform infrastructure providers) to another (logistics companies). To complicate things, the higher the stakes and the more vested the interests, observable behaviour and formal strategy might differ from the real (but hidden) agenda of stakeholders and a mapping of stakeholders may offer a false sense of overview and insight here. This is to show that mapping stakeholders is very sensible, but don’t expect an easy answer…